The U.S. meetings market has lagged in its recovery from the depths of the 2008/2009 lodging industry recession. While transient demand started to grow during the latter part of 2009, it wasnt until 2011 that significant gains were seen in group room nights.

This is one of several “mixed messages” found when reviewing the results of PKF-HR 2013 survey of meeting planners sponsored by ConventionSouth magazine. In October of 2013, a total of 66 planners located across the country answered questions about the events they were organizing for the year. While the survey focused on events held in the southeast region of the nation, the meeting planners were located throughout the country.

The following paragraphs highlight other findings from the survey that indicate why 2013 was a fickle year for the U.S. meetings market, how planners reacted, and what they see for the future.

Delegates and Dollars

In addition to the mixed message regarding the change in number of events planned from 2012 to 2013, attendance levels improved for some planners, but declined for others. More than half the planners surveyed (54%) indicated that the number of delegates at their meetings was up from 2012 levels. Roughly one quarter of these fortunate planners said their attendance “increased greatly.” Conversely, 18 percent of the respondents saw attendance at their meetings decline. However, it should be noted that none of the respondents indicated that attendance “decreased greatly.”

Both of the percentages of planners reporting increases or decreases in attendance are greater than what was reported in the 2012 survey, indicating volatility, not stability, in the meeting attendance figures.

With event volume and attendance vacillating, it is not surprising that 46 percent of the planners surveyed reported an increase in their meeting expenditures during the year, but 41 percent said their expenditures remained the same. Rising event costs (venues, food, beverage, hotel rooms, travel) were cited as the main reason for any growth in expenditures, as opposed to a deliberate increase in the investment for meetings.

Given the lack of intentional increases in expenditures, it is interesting to note that food and beverage was ranked as the number one rising cost. This is in sharp contrast to last year’s poll that cited food and beverage expenditures as an area that planners were cutting back on.

Part of the reason for this change in food and beverage spending trends may be attributable to the attitudes of hotel operators. The planners in our survey indicated that hotel managers were most willing to make price concessions for internet access and meeting space. However, food and beverage and meeting services were much further down the list. Other items not frequently up for negotiation were cancelation fees and resorts fees.

Room Rates and Availability

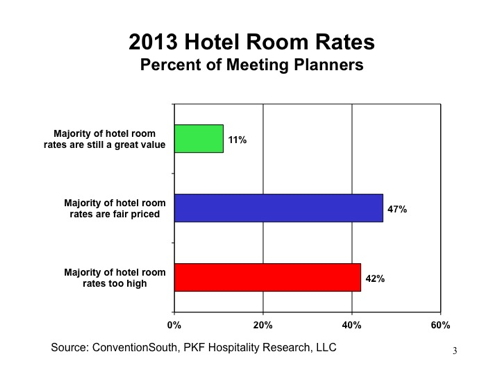

A change in the perceptions of meeting planners towards hotel room prices and availability is yet another indicator of the changing environment for meetings. In 2013, hotel room rates were ranked as the most important criteria planners contemplate when deciding on a meeting venue. This is an increase from the number four ranking this criterion received in 2012.

One reason for the increased sensitivity towards room rates is a decline in the perceived value. While 47 percent of the planners believed hotel rooms were fairly priced, 42 percent thought they were too high.

Another reason is an acknowledgment by planners that market conditions, and therefore negotiating leverage, has turned in favor of hotel sales managers. The percentage of planners finding it more difficult to locate available hotel rooms for 2014 than it was in 2013 went up from 18 percent to 23 percent. Conversely, the percentage of planners finding it easier to book rooms declined from 35 percent to 28 percent for the same period of time.

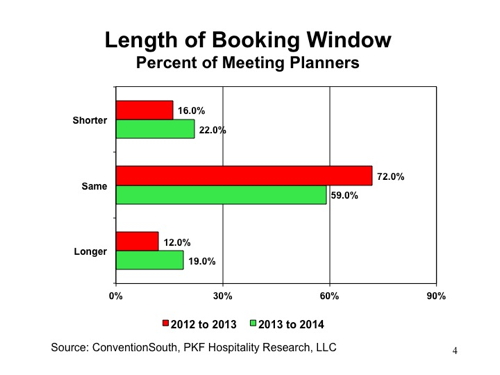

The Booking Window

Despite the acknowledgement that hotel rooms are becoming scarcer, we see additional mixed messages when looking at planner expectations regarding the length of advanced time required to book a meeting. As expected, the percentage of planners indicating an increase in the length of the booking window rose from the 2012 to the 2013 survey. However, we also saw a rise in the number of planners reporting a decline in the booking window.

One historical issue that appears to have subsided is the incidence of attendees booking their hotel rooms outside of the official group block. Only 10 percent of the survey participants cited this as a significant problem. A majority of planners did indicate that they encourage hotels to limit the availability of alternative discounted rates. This is a solution that potentially benefits both the meeting planners and the hotel sales manager.

Stability in the Future

Meeting planners may not like it, but we believe the volatility shown in 2013 is just a reaction by meeting planners to the inevitable stability that will occur in the marketplace as the lodging industry approaches the top of the recovery curve. Of course, while at the top, market conditions will favor hoteliers.

PKF-HR’s December 2013 Hotel Horizons® forecasts call for occupancy levels in excess of 70 percent in the luxury, upper-upscale and upscale lodging categories. These are the chain-scales in which most meeting hotels operate. Accordingly, we expect sales managers will continue to become more aggressive with their group room rate pricing, and less compelled to offer other price and service concessions.

If meeting planners were mixed in their attitudes in 2013, they may be unified in their frustration towards hotels in 2014 and beyond.

Robert Mandelbaum and Gary McDade work in the Atlanta office of PKF Hospitality Research, LLC (www.pkfc.com). Special thanks to Marlane Bundock, Managing Editor of ConventionSouth, for sponsoring the survey. This article was published in the January 2014 edition of Lodging.